Businesses are always working to make their processes more efficient, and the same goes for lenders who offer loans to consumers. Since loan origination is one of the first steps in the lending process, it is often the starting point for using new technology. To process loans, lenders need to collect a lot of information and carefully assess whether the applicant is likely to repay the loan. They also have to follow a variety of rules and regulations. Beyond just building a portfolio of loans, lenders should see this stage as a chance to build strong relationships with customers.

The large amount of data collected during the loan origination process makes it a good fit for digital tools. Technology can help lenders improve their operations by speeding up tasks and lowering risk. This leads to faster decisions and a better experience for customers. While technology like BankPoint can be helpful in any part of a lender’s operations, it often makes the biggest impact during the loan origination stage.

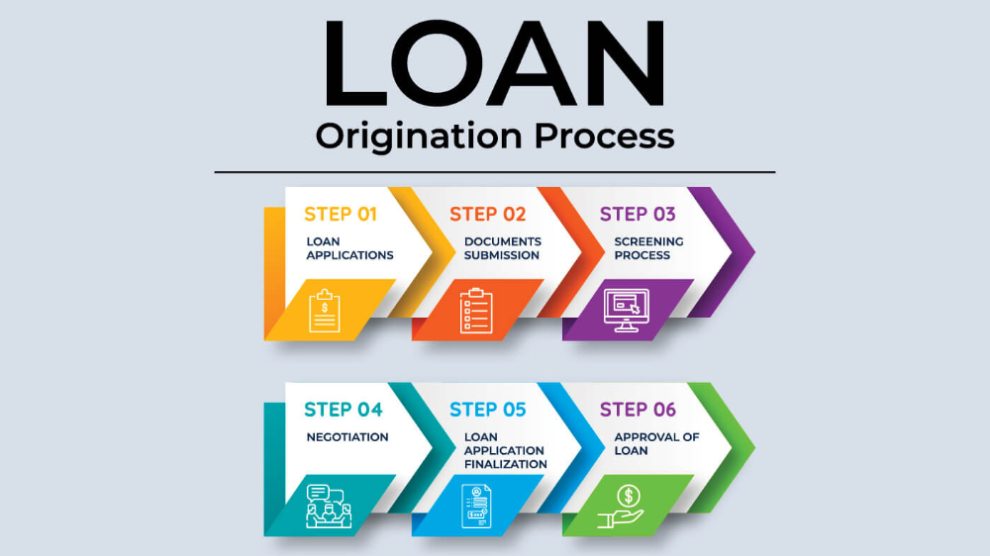

Steps in the Loan Origination Process

From the first step of prequalification to the final step of loan funding, technology brings advantages to both lenders and customers. Modern loan origination systems (LOS) help automate tasks, speed up communication, and reduce risk. Fast decisions show customers that a lender has an efficient process, which helps build trust and confidence. At every step, technology adds security and helps make the process smoother for everyone.

The 6 Steps of the Loan Origination Process

1) Pre-Qualifying Period

In this early stage, applicants submit personal and financial information, which lenders use to help make loan decisions.

2) Applying for a Loan

With digital loan systems, applicants can apply online from a computer or mobile device.

3) Processing the Application

A modern LOS uses automated rules to check if the applicant is likely to repay the loan.

4) Underwriting Process

Lenders closely review the applicant’s financial data to identify and reduce risk.

5) Quality Control

Here, the application data is checked to make sure it follows all rules and guidelines.

6) Funding the Loan

This is the final stage. Once everything is in order, the loan is approved and the funds are given to the borrower.

Step 1: Pre-Qualifying Period

During this step, applicants are asked to submit a list of personal and financial details that help lenders make informed decisions. This information includes:

- Bank account type

- Place of birth

- Employer information

- Date of birth

- Email address

- Current job

- Signature

- Source of income

- Full legal name, including any maiden or middle names

- Marital status

- Permanent home address

- ID number from a photo ID

- Phone numbers

Loan systems are set up to collect and use this data to support better decision-making. A good loan origination system is flexible, meaning it can be adjusted to meet the lender’s needs and changing market conditions. These flexible systems also help lenders reach out to borrowers who are close to paying off their loans and offer them new deals.

Step 2: Applying for a Loan

The loan application process can be difficult for both customers and lenders. This is one reason why many lenders now offer digital applications. When applications were on paper, it was common to see missing or incorrect information. Online applications help reduce these problems.

Benefits of digital loan applications include:

- Helping lenders react to changing market conditions

- Letting applicants apply from anywhere with internet access

- Allowing easy uploads of required documents like photo IDs

- Making the process more accurate by guiding users through each step

- Avoiding delays caused by manual reviews

- Making fast decisions, sometimes without the need for an underwriter

- Reaching more customers, especially those who prefer using mobile devices

- Letting lenders target specific customer groups more effectively

By automating this part of the process, lenders can also learn more from the data applicants provide, helping them offer better services. Digital applications also speed up the process, which means lenders can grow their customer base without taking on extra risk.

Step 3: Processing the Application

At this stage, the credit team reviews the application to make sure all required fields are filled in and the information is correct. Many digital applications will not allow someone to move forward if something important is missing, which helps avoid delays.

A good loan origination system will apply rules automatically to check if the applicant is creditworthy. This helps lenders make fast decisions and stay in compliance with regulations. In some cases, the system will flag certain applications for further review. At that point, lenders can use extra data, like alternative or trending credit information, to get a better picture of the applicant’s financial behavior.

Step 4: Underwriting Process

In this key step, lenders look closely at the applicant’s credit score and other data to understand the risk involved. A good LOS can help guide what happens next, such as:

- Asking for more information

- Pulling more details from internal or external systems

- Automatically approving, declining, adjusting, or restructuring the loan

- Using pricing tools to find the best deal for both the borrower and the lender

Automation helps lenders make decisions based on data and keeps a record of those decisions in case they are reviewed later. Even with automation, underwriters are still important, especially for applications that need more careful review.

Step 5: Quality Control

This is the last stage where the lender can check that the application meets all rules and regulations. Since lending is a highly regulated field, having automation in this step is helpful.

Technology reduces the amount of manual work required, allowing staff to focus on other important areas. It also helps speed up decision-making and lowers the chance of human error.

Even though lending involves people, using automated systems at this step can improve the process for both lenders and borrowers. When this stage runs smoothly, it shortens the time between approval and when the funds are delivered, which is very important in today’s lending environment.

Step 6: Funding the Loan

Most consumer loans are funded once all the necessary checks are completed. Technology also helps during this final step. Before funds are released, the LOS confirms:

- All required data has been gathered

- The applicant’s ability to repay has been evaluated

- The underwriter has approved the loan

A loan origination system can also track the funding process and prepare the loan for servicing. With payment systems connected to the LOS, borrowers can set up automatic payments after the loan is approved.

For lenders, what happens after the loan is funded is just as important as the loan itself, since loan repayment is where their income comes from.